So, I came across this brilliant comedian on Facebook the other day, and Facebook, in all of their infinite wisdom censored it from me, according to their factcheckers (who have done absolutely nothing to curb climate change, by the way).

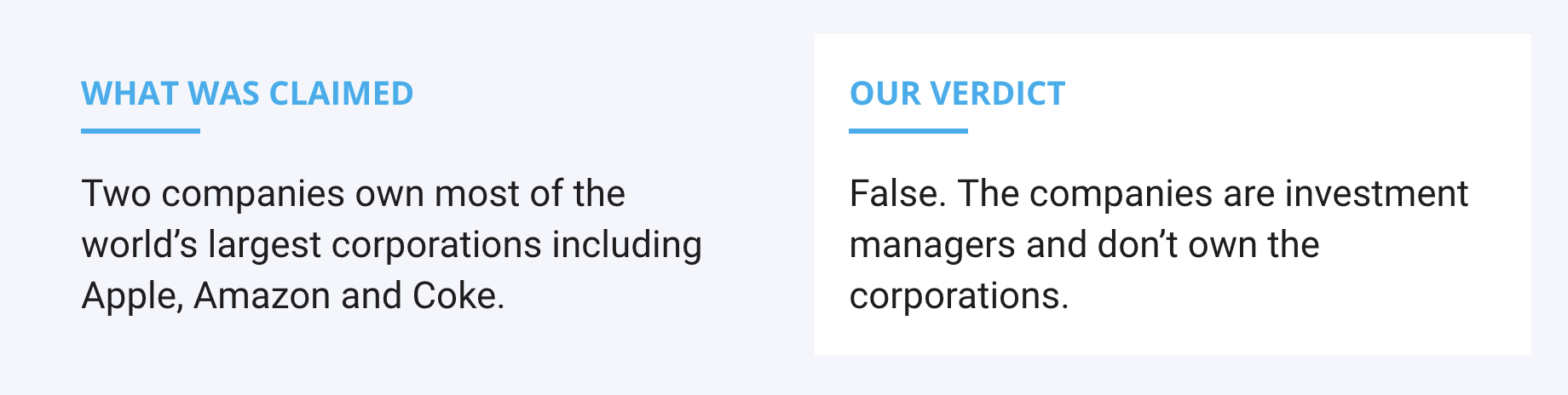

Toni Bologna claims Vanguard and Blackrock own the world – and it turns out they do. Only they do so with a few of their friends, according to ‘fact checkers’.

AAP – the Australian Associated Press fact checkers – are funded by major corporations. It makes sense that they wouldn’t want people revealing that fact. Because that would undermine their legitimacy, and the standing they have to fact check (read: censor) those who they disagree with, like this dancing lady fact checking them: https://www.aap.com.au/factcheck/global-corporate-monopoly-claim-dances-on-edge-of-reality/

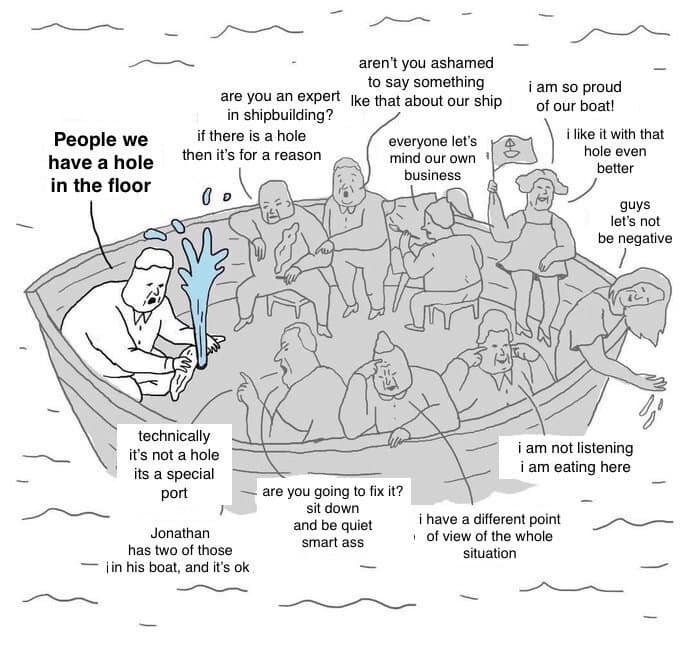

Their article goes to pains to show that Toni Bologna is in fact correct in her assessment, but spin it by the letter of the law rather than the spirit. This is spin doctorism at it’s most wall street shamanic.

It is narrative control while admitting wholeheartedly to the open conspiracy of a few corporations controlling virtually all capital.

What is striking is this is not a video getting millions of views, and telling people to overthrow their governments. No, it has been shared less than a thousand times, with probably as many watches. So why pick on small fry? Especially when there are real misinformation artists out there with weapons and deadly intentions? Maybe because these “false” by-a-technicality claims are directed at the very platforms and factchecking funders themselves?

For simplicity’s sake, I’ve reposted AAP’s entire article below. See if you can point out how they both admit to the truth claim while spinning it as if it was false, when really, they are saying they win on a technicality.

Global corporate monopoly claim dances on edge of reality

AAP FactCheck March 18, 2022

A video shared on Facebook claims two companies own most of the world’s corporate giants including competing firms Apple and Microsoft, and Coke and Pepsi.

The social media user makes the claim in the video while performing an interpretive dance.

However, experts have told AAP FactCheck the two companies she names, BlackRock and Vanguard, are investment managers which in most cases “own” less than 10 per cent of shares in the corporations and have a negligible influence on them.

The video has been posted on Facebook accounts such as this one (archived here). The post’s text says: “Want to know who REALLY runs the world ?? Everything is owned by the same people, and I’ll admit. Their strategy to conceal it, is clever.”

In the video, the woman says: “Since the 1970s, two corporations have gobbled up most of the earth’s companies – Vanguard and BlackRock,” (video mark 6 sec).

Later she says: “These two mega-corporations own all the smaller corporations so we have a monopoly inside of a monopoly. Vanguard and BlackRock own Coke and they own Pepsi. They own Apple and they own Android, i.e. Microsoft. They own American Airlines, they own Delta. They own oil and they own solar. They own eBay and they own Amazon,” (video mark 50 sec).

It’s true Vanguard and BlackRock are major shareholders of many corporations she names, strategically investing their client’s money in order get a good return.

At the time of writing, Vanguard is Apple’s major shareholder with 7.33 per cent of stock, while BlackRock is third at 4.14 per cent. Vanguard is also Microsoft’s major shareholder at 7.80 per cent; BlackRock second at 4.45 per cent.

Vanguard is Pepsi’s major shareholder at 8.44 per cent; BlackRock second at 4.73 per cent. Vanguard is Coca-Cola’s second major shareholder at 7.55 per cent; BlackRock third at 4.13 per cent.

But they are not alone in dominating the shareholdings.

Businessman and philanthropist Warren Buffett’s investment company Berkshire Hathaway is Apple’s second-largest shareholder and Coke’s major shareholder.

Asset managers State Street is the third-largest shareholder in Microsoft, Pepsi, eBay and Amazon.

However, financial experts say it’s incorrect to equate these shareholdings with control of the corporations.

Rob Nicholls is associate professor of regulation and governance at the UNSW Business School and widely published in areas such as common ownership.

He told AAP FactCheck that because there are large money market funds or institutional investors in most developed countries, there is a degree of common ownership, but that isn’t a monopoly.

“It just says they (BlackRock and Vanguard) might each be the largest shareholder in a large number of businesses, but that large shareholding is likely to be in proportion through the relevant index – so they might be the largest shareholder because they have seven per cent of the shares,” he said in a phone interview.

“Occasionally they get to 10 (per cent), but that doesn’t mean that they control that business. It doesn’t always mean they influence that business.”

Dr Nicholls says Vanguard and BlackRock are not “owners” of corporations in the sense depicted in the Facebook video.

He says investors who want exposure to the stock market can purchase an exchange traded fund, a passive investment that buys shares in proportion to market capitalisations – but someone has to actually buy the shares that build the funds and that’s the role of Vanguard and BlackRock.

“So what you tend to find is that large businesses, because of their market capitalisations, tend to have the larger institutional investors as significant or major shareholders – and indeed so significant that on disclosure listings the likes of BlackRock and Vanguard appear to own everything.”

Lorenzo Casavecchia, a senior lecturer at UTS Business School, told AAP FactCheck an investor can only control a company if they have more than half of the votes cast at a general meeting.

“Even the largest of the index funds (e.g., Vanguard) will have very small absolute ownership stakes (around 5%) in Australian companies,” Dr Casavecchia said in an email.

“While such holdings could influence proxy voting or firm governance matters it is difficult to imagine how a single institutional investor with a small percentage holding would have the motive and influence (or capability) to push corporate executives to engage in uncompetitive practices across an entire industrial sector.”

Adam Triggs, research director at ANU’s Asian Bureau of Economic Research, also told AAP FactCheck it’s inaccurate to say Vanguard and BlackRock own many of the world’s largest companies.

“They invest money on behalf of other people and (are) not the beneficial owners themselves,” Dr Triggs said in an email.

“They are the largest single shareholder in many publicly listed companies but this is not the same as ownership.”

However, Dr Triggs says there’s evidence common ownership of competing firms, such as Coke and Pepsi, reduces competition and has argued this can cause anti-competitive outcomes.

The Verdict

The claim two companies own most of the world’s major corporations is false. Experts told AAP FactCheck that Vanguard and BlackRock are two of the world’s biggest investment managers and appear among the top shareholders of many corporations, without actually owning them or having a major influence on how they are run.

Vanguard and BlackRock are also not exclusively the major shareholders. Investment companies State Street and Berkshire Hathaway also appear among the top shareholders of many large corporations.

False – The claim is inaccurate.